Palladium is a precious metal widely used in various industries, including automotive, electronics, dentistry, and jewelry. It is particularly valued for its catalytic properties, making it a critical component in automotive catalytic converters. Understanding the price trends of palladium is crucial for businesses involved in its production, distribution, and utilization. This article provides a comprehensive analysis of price trend of palladium, covering historical prices, recent fluctuations, market dynamics, and future outlook.

Market Overview

The global market for palladium is influenced by factors such as supply from mining operations, demand from key industries, geopolitical factors, and economic conditions. Major producers include countries like Russia, South Africa, Canada, and the United States. The demand for palladium is driven by its applications in automotive catalytic converters, electronics, dentistry, and jewelry.

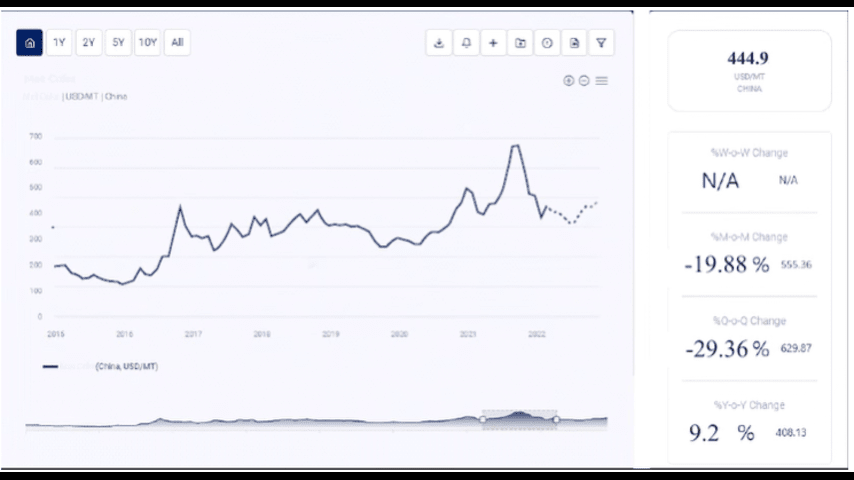

Historical Price Trends

Over the past decade, palladium prices have experienced significant fluctuations. From 2010 to 2015, prices averaged around $500 to $800 per ounce. This period of relative stability was due to steady demand and consistent supply. However, from 2016 onwards, prices began to show more volatility due to several factors:

Increased Demand: Growth in the automotive industry, particularly for catalytic converters, boosted the demand for palladium.Supply Constraints: Mining challenges and geopolitical tensions in key producing regions affected supply.Investment Demand: Palladium also attracted investment demand, adding to price volatility.

Enquire For Regular Prices: https://www.procurementresource.com/resource-center/palladium-price-trends/pricerequest

Recent Price Trends (2023)

In 2023, palladium prices ranged between $1,800 and $2,500 per ounce. The following factors contributed to these price trends:

Automotive Demand: The automotive industry’s demand for catalytic converters, driven by stricter emission regulations, continued to support high prices.Supply Disruptions: Political instability in major producing countries like Russia and South Africa led to supply constraints.Economic Conditions: Fluctuations in global economic conditions, including inflation and interest rates, impacted investment demand and overall market sentiment.Market Dynamics

Several market dynamics influence the price trends of palladium:

Supply FactorsMining Production: Changes in mining production, particularly in major producing countries, significantly impact global supply and prices.Geopolitical Factors: Political stability and trade policies in key producing regions affect production and export capabilities.Secondary Supply: Recycling of catalytic converters contributes to the secondary supply of palladium, influencing overall market balance.Demand FactorsAutomotive Industry: The automotive industry is the largest consumer of palladium, using it in catalytic converters to reduce vehicle emissions.Electronics Industry: Palladium is used in various electronic components, including connectors, capacitors, and semiconductors.Jewelry and Dentistry: Palladium is used in jewelry and dental alloys, contributing to its overall demand.Investment Demand: Palladium attracts investment demand, particularly in times of economic uncertainty, affecting its price volatility.Market TrendsTechnological Advancements

Advancements in automotive technology, such as the development of electric vehicles (EVs), may influence future demand for palladium. While EVs do not require catalytic converters, the transition to EVs is gradual, and hybrid vehicles still use palladium in their catalytic systems.

Sustainability and Environmental Impact

Efforts to reduce the environmental impact of mining and promote sustainable practices are gaining momentum. Companies are focusing on reducing emissions, improving recycling processes, and developing alternative technologies. These initiatives may affect production costs and supply but offer long-term benefits in terms of environmental sustainability and market appeal.

Market Segmentation

The palladium market can be segmented based on its applications:

Automotive: Used in catalytic converters to reduce vehicle emissions.Electronics: Used in connectors, capacitors, and semiconductors.Jewelry: Used in jewelry production for its luster and durability.Dentistry: Used in dental alloys for crowns and bridges.Investment: Traded as a commodity and used in investment products like bars and coins.Future Outlook

The future of the palladium market looks promising, with expected growth driven by continued demand from the automotive and electronics industries. However, price volatility may persist due to factors such as supply constraints, geopolitical tensions, and economic conditions.

Recent DevelopmentsCapacity Expansions: Companies are investing in expanding their production capacities to meet growing demand, particularly in regions like Russia and South Africa.Sustainability Initiatives: Increasing focus on sustainable mining practices and reducing the environmental impact of palladium production.Market AnalysisCompetitive Landscape

The palladium market is dominated by a few key players, including:

Norilsk NickelAnglo American PlatinumImpala PlatinumSibanye StillwaterNorth American PalladiumKey Players

These companies are involved in the mining, processing, and distribution of palladium. They are focusing on strategic partnerships, technological advancements, and sustainable practices to maintain their market positions.

FAQs

Q1: What factors influence palladium prices? A1: Palladium prices are influenced by supply-demand dynamics, mining production, geopolitical factors, technological advancements, and economic conditions.

Q2: Which industries are the largest consumers of palladium? A2: The automotive, electronics, jewelry, and dental industries are the largest consumers of palladium.

Q3: How do geopolitical factors affect palladium supply? A3: Political instability and trade policies in major producing regions, such as Russia and South Africa, can disrupt production and supply, impacting global prices.

Q4: What is the future outlook for the palladium market? A4: The future outlook for the palladium market is positive, with expected growth driven by continued demand from the automotive and electronics industries. However, price volatility may persist due to various influencing factors.

Conclusion

The palladium market is characterized by its dependence on the automotive, electronics, jewelry, and dental industries and is subject to fluctuations due to changes in supply-demand dynamics, geopolitical factors, and broader economic conditions. As technological advancements and sustainability initiatives continue to evolve, the market is expected to grow, offering opportunities and challenges for stakeholders.

By diversifying supply sources, investing in technology and sustainability, and staying informed about market trends, companies can better position themselves to capitalize on opportunities and address challenges in the palladium market. Effective planning and proactive management will be key to maintaining competitiveness and achieving long-term success in this evolving industry. Monitoring price trends and staying updated with industry developments will be crucial for making informed business decisions in the palladium market.